Competitionism

Users browsing this topic:0 Registered, 0 Hidden and 0 Guests

Registered Users: None |

|

| View previous topic :: View next topic |

| Author |

Message |

pietillidie

Joined: 07 Jan 2005

|

| Post subject: Competitionism |  |

|

<split from 'China' thread>

| Wokko wrote: | | pietillidie wrote: |

But what if the views of certain dissidents don't represent workable reform? What if there are four other options and their particular angle leads nowhere?

Think within our context: If you knew nothing about Australia, would you do well to side with the dissidence of Reclaim Australia? Or the US Tea Party? Or the Socialist Alternative?

Again, it's not that I don't think there are good critiques, it's just that no one can explain to me what a serious critique and a serious reform platform within the China context looks like.

Consider Iraq: The mainstay of the conservative claim was ridding the world of Saddam; of course everyone was fine with that, but certainly not at the expense of even greater chaos and bloodshed.

Until we have the appropriate fine-grained insight, we might be condemning even more people to even more suffering. Blindly acting is not somehow morally superior to requesting serious information.

Note, I didn't say do nothing as a matter of policy. I challenged people to find out more before pontificating. As I say, if it were Korea I would have no problem making a call.

Think about it: People wouldn't make a call on even a fraction of their share portfolio with so little information! |

That's quite the argument for conservativism there, maybe there's some hope for you yet  |

Haha. I'm definitely not a radical, because I don't rate instability. I rate persuasion, adaptability and agility.

That probably makes me more a negotiated third-wayer: Let's find a good solution and push forward with it, and stop defending ways and ideas that have had their day. I think I got that from studying Keating closely, as much as anything. But when I say "third-wayer" I mean it in the sense of "alternative solutions", not in a sickly Blairite way which means "what the elite want plus a few crumbs and a reduction in the moochers and leaners rhetoric." I mean there are multiple alternatives for the better of the whole, and one's political duty is to put them into play.

And, as you know, I believe in competition quality, so that's also a major break from the old left which forever falls into protectionism and incentive elimination. I don't mind incentive gaps; I just want them to be highly fluid, with capital in motion, which is another way of describing "competition quality". I'd be happy to make ten million bucks through my startup work, say; but it's use it productively and competitively or lose it as far as I'm concerned. There's no parasiting off a society everyone else has built by living off safe fixed incomes, which by definition are anti-competitive.

_________________

In the end the rain comes down, washes clean the streets of a blue sky town.

Help Nick's: http://www.magpies.net/nick/bb/fundraising.htm |

|

|

|

|

Mugwump

Joined: 28 Jul 2007

Location: Between London and Melbourne

|

| Post subject: |  |

|

^ but on the "use it or lose it once you've made it" principle, then does that mean that you have to keep it employed in your own business, rather than lending it (ie your fixed interest option) to someone else ? And if you do keep it employed in your own business (or you can only start some new business with it), who's to say that your next employment of the capital is better than someone else's, and more importantly, how do those without the capital get started at all, without access to borrowing ?

Perhaps I do not understand what you mean, but lending at interest is just allowing someone else to access the capital and earn a higher rate of return with it, which is (financially speaking) how capitalist growth happens.

_________________

Two more flags before I die! |

|

|

|

|

pietillidie

Joined: 07 Jan 2005

|

| Post subject: |  |

|

| Mugwump wrote: | ^ but on the "use it or lose it once you've made it" principle, then does that mean that you have to keep it employed in your own business, rather than lending it (ie your fixed interest option) to someone else ? And if you do keep it employed in your own business (or you can only start some new business with it), who's to say that your next employment of the capital is better than someone else's, and more importantly, how do those without the capital get started at all, without access to borrowing ?

Perhaps I do not understand what you mean, but lending at interest is just allowing someone else to access the capital and earn a higher rate of return with it, which is (financially speaking) how capitalist growth happens. |

The lending will still be happening, it's just qualitatively different lending, with wealth over a certain level having to forgo the lower-risk markets, leaving them for other national stakeholders to invest in (possibly at the same time dealing with the endemic problem of retail and smaller investors being crowded out of opportunity due to a lack of industry heft, if I've understood that issue correctly).

Personally speaking, I think I can approximate what I would like to achieve by investing in asymmetrical tech in key areas which can help reduce rents and increase productivity at the same time (e.g., renewables versus my favourite anti-competitive whipping boys, the fossil fuels industry, or a whole host of new tech versus the natural monopoly government contract thieves getting inflated returns for what are basically sovereign-guaranteed investments, and so on).

Of course, this whole discussion lies at the centre of economics, and is essentially what a progressive tax system is supposed deal with by other means.

My working hypothesis is that Piketty is right enough even if he hasn't quite been able to nail it: r>g, or something like r is greater than something like g. I think we know the mechanism underlying Piketty is political capture (policy and class capture alike), but we can't isolate, expose and measure that phenomenon very easily. Using another field as an analogy, it's a bit like the awakening which accompanies Freud's ingenious observation that "depression is anger turned inward", but not quite being able to confirm it empirically even if it makes complete sense of everything we know about depression.

Of course, in the received equilibrium ideologies my idea would be snookered by a circular problem whereby I need the market to price the asset to know the asset's risk premium, and if the market prices the asset as low-risk, then the rate of return is supposed to reflect that as a natural disincentive already. However, the assumptions behind the received story are questionable on one account, and denialist and fanciful on another: First, we're now not acting blindly across many asset classes, knowing their long-term rates of return with increasing precision, if I'm not mistaken (think no further than housing, high-end sovereign debt and blue chips, as simple 25-year examples). And this is what you would expect to find of any discipline as it matures: Better data, more stable records, improved expectations. Put simply, better engineering. Second, it's time to grow up and admit we know full well that out the back of the sausage factory of the market there all kinds of bloody asymmetries and dirty rents all over the shop. These two things have implications for policy that were unthinkable from the confines of the straight jacket of a defensive, paranoid modernism, such as during the Cold War years.

Within very narrow constraints, it looks like markets are all about supply and demand and magical Jesus equilibrium pricing, mostly because that's where the ideological illusionists direct our eyes, and partly because the frictions are often hard to see, especially as no one willingly publicises anti-competitive or quasi-criminal behaviour! Instead, it will be hidden behind closed doors or buried in layers of PR (hence the corporate hysteria over Wikileaks, which really does scare the shite out of companies). People generally only notice this blood and gore during crises and massive scandals, after which they're dismissed as natural, periodic events (the GFC) or conversely mercurial one-offs (Enron, Madoff, flash crashes). Meanwhile, the spoon-feeding of decidedly non-market bailouts and other Reserve Bank interventions are downplayed as if the roving GP has dropped by for his decadal visit to check an otherwise tip-top, fit and firing specimen of health.

But, much more important than these distracting, highly-visible moments, are the countless daily corrupt handshakes and anti-competitive actions behind the float of assets, procurement of contracts, granting of licenses, non-rational human network-based decisions, and trivia such as plain old geographic frictions, and so on. All the audience is shown, of course, is the sanitised, unbounded bidding process which happens in public markets, which is then conveniently and religiously framed as the totality of what is going on.

Well, not quite: Business schools don't teach "unfair advantage" and promote their "unrivaled business networks" in aid of more competitive transactions! On the contrary, just imagine all the non-rational factors, from geopolitical pressure at the top end of town, to inside contacts, jobs for the boys, mates rates, back scratching, legislation writing and re-writing, re-zoning, re-prioritising, heads up, backroom agreements, trade negotiations, arm twisting, unwritten blackmail and incentives, PR campaigns, smear campaigns, legal threat, legal wrangling, and so on, that interfere with competitive processes in the realm of large corporate and corporate-government business in the big bad real world.

Then there are all the captured natural monopolies, and the capital-intensive industries that only a handful of giant corporations in the right area could access if they wanted to, making them virtual natural monopolies. And just imagine what percentage of real costs across the globe are externalised; it would be monstrous! Consider pollution alone, which Australians in their vast geography and 80% service economy rarely see. And let's not even start with the farcical line between "proprietary knowledge" and insider trading, and complete market hacks like speed trading. I mean, the disembodied, sanitised transactions in the middle everyone watches on the boards and indices on TV would be lucky to reflect a quarter of the full story.

And this is why, of course, there is a managerial class and elite alumni groups to start with: It takes some degree of normalisation training to hold that whole edifice of contradictions together, and to justify it as not just rational, but also admirable and warranting of special praise. Hence at the extreme end we get the cult-like defensiveness and counter-slogans such as "job creators", and uberman mythologies.

Even so, the physics of markets as they really do exist outside the fantasies still consist of major dynamics which need to be worked with and ideally harnessed, rather than wished away on the one hand, or turned into irrepressible cosmic forces on the other.

Thus, as mentioned, I'm mulling over something practical like this: Over a certain amount of wealth, capital has to be invested at a certain minimum risk premium. Behaviourally, that surely feels a lot better than a tax, incentivising as it does the capitalist to seek disruptive investments by necessity, thereby loosening the anti-competitive gravitational pull of capital mass, and bringing new players (actual entrepreneurs, rather than capital hoarders) into the game. This would also make safer asset classes the realm of the retail and ordinary investor who deserve a greater share of the prosperity, which ordinary folk currently (though decreasingly) receive as national shareholders through equity in their homes and gouging fund intermediaries. But residential homes are only one example of an asset which, rather than reflecting any great entrepreneurial genius, are products of the quality, stability and productivity of the nation as a whole.

Unfortunately, as with the GFC bailouts and the rapid re-establishment of systemic risk thereafter, Financial Mohammeds always manage to bring the mountain of sovereign protection to themselves. So, if we can't get the same folk to pay taxes, it's still going to be extremely difficult to get them to do anything without the threat of bloodshed. That said, the behavioural dimension of what I'm suggesting would surely be much more psychologically palatable than the raising of still more taxes.

Also, certain psychiatries, or psychiatries trapped in certain narrow confines, such as those in elite social sects, or those in elite attache classes such as the managerial class, are driven by less productive ends. While all of us harbour such nasties as a desire for domination, feelings of self-entitlement, god complexes, and fear and paranoia, finding a behavioural solution that generalises across very isolated, resistant sub-sects is not an easy thing to do.

But, given equilibrium approaches are verging on the ridiculous in a real world of ubiquitous and often massive transaction frictions and anti-competitive asymmetries, it's not as if the bar has been set very high here. Contrary the fundamentalist red scare which inevitably bears down on any effort to view markets realistically and scientifically, new approaches obviously don't have to be close to perfect to still be more reasonable than the wishful, utopian thinking which accompanies the state religion of rational markets and rational (and law abiding and moral!) actors.

_________________

In the end the rain comes down, washes clean the streets of a blue sky town.

Help Nick's: http://www.magpies.net/nick/bb/fundraising.htm |

|

|

|

|

Mugwump

Joined: 28 Jul 2007

Location: Between London and Melbourne

|

| Post subject: |  |

|

^ i'd need less of a Sunday afternoon headache to understand all that - but the core of it seemed to be this idea that "wealth above a certain level needs to be invested above a certain risk premium".

But since risk is by definition unknowable, who assesses risk "premium" (though i think you just mean risk, not "risk premium") ? Isn't it risky to invest in BHP, whose shares have fallen by 25% in the last year or so ?

If you mean invest in disruptive technologies, then who defines what they are, and how do you stop mad bubbles in (say) biotech shares, or the internet companies in 2000 ? And is Google a disruptor, or an incumbent ?

I don't really think that there is a dramatic lack of disruption in the modern economy, though perhaps it depends on your benchmark. 25 years ago PCs had barely penetrated the marketplace, renewables were nowhere, there were no serious low-cost airlines, Chinese manufacturing was a backwater, etc. Since I work with large global businesses, I am certain that this globalised world is about 100x more competitive than the old nation-border businesses used to be. Some industrial giants have got bigger as a result, because they are more compeitive than smaller firms, and barriers to entry do exist in large capital and knowledge intensive industries, whihc probably does allow some supernormal profits.

I doubt that forcing wealthy individuals to invest in smaller firms (or whatever) will change that, and i fear that it'd cause destruction of capital on a very large scale, but it is, I admit, an intriguing idea.

_________________

Two more flags before I die! |

|

|

|

|

HAL

Please don't shout at me - I can't help it.

Joined: 17 Mar 2003

|

| Post subject: |  |

|

| No really, it's true. We have nothing to fear, but fear itself. --FDR |

|

|

|

|

pietillidie

Joined: 07 Jan 2005

|

| Post subject: |  |

|

Mugwump, I guess the argument would be that investments with a low premium can easily get other kinds of capital already, so it wouldn't be robbing them of capital, it's simply adjusting the mix of investors, especially given the known problem of big wealth squeezing out other investors. Not to mention over-subscription in low-premium investments is surely inflationary.

I did discuss the circular valuation problem, which is a decreasing problem, especially given that periodic volatility in many asset classes is already well-accounted for by most existing indices, which have long records of industry development already. So, I'm not inventing anything new that finance isn't already doing. I mean, the fact that, say, blue chip companies outperform real estate over 25 years is not my conclusion, so Google is wherever the existing indices put it!

Note, the idea says nothing about what good investment practice should look like, it's just redirecting massive wealth from protectionist inflationary investments, to more productive and dynamic ends.

Also, when thinking about these things, it's not a case of the incumbent being assumed "right"; incumbency says nothing. We know many of these things are inflationary and that means highly costly; we know political capture is highly costly. So it's not a case of "if it's not broke...", which is of course how it will be wrongly framed. It's a case of trying to solve a highly costly, destructive problem. It's an effort to improve upon a sub-optimal system. But it's not a radical break; it's a hardened commitment to HQ capitalist competition.

Of course, that's not to say those with better knowledge than I can't think of a more effective way of going about it, but the premise that idle capital does the Devil's work is a good place to start, especially in a context of a widening wealth gap and downward pressure on social quality.

When you think about post-industrial societies more broadly, accepting a devaluation of social quality on the basis of outdated economic slogans is by far the riskier and flakier angle here, and it should be the approach on the back foot from the outset because the funding shortfalls and wealth gaps show it's beginning to fail contemporary post-industrial society. Doubling-down on a failing approach due to familiarity and fear will not do.

_________________

In the end the rain comes down, washes clean the streets of a blue sky town.

Help Nick's: http://www.magpies.net/nick/bb/fundraising.htm |

|

|

|

|

pietillidie

Joined: 07 Jan 2005

|

| Post subject: |  |

|

| Mugwump wrote: | | I don't really think that there is a dramatic lack of disruption in the modern economy, though perhaps it depends on your benchmark. 25 years ago PCs had barely penetrated the marketplace, renewables were nowhere, there were no serious low-cost airlines, Chinese manufacturing was a backwater, etc. Since I work with large global businesses, I am certain that this globalised world is about 100x more competitive than the old nation-border businesses used to be. Some industrial giants have got bigger as a result, because they are more compeitive than smaller firms, and barriers to entry do exist in large capital and knowledge intensive industries, whihc probably does allow some supernormal profits. |

On this point, the "disruption" story you're talking about is likely a product of perception relative to different criteria than those I'm focusing on. (I probably flagged that view when I mentioned venture investment, but that was just a personal example rather than a general prescription).

The broader disruption I'm looking for shows up in the data as economic mobility and access and is relative to where we are as a postindustrial society. From this perspective, "disruption" is not keeping up with needs and expectations of the present level of development.

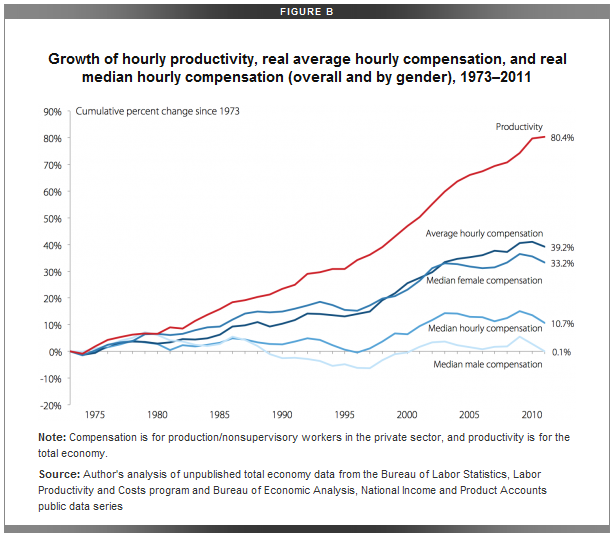

The first important fact is that the tax system can't cope with the distorted, irrational returns to capital at the very top end in post-industrial economies. The second important fact is that real wages are not keeping up with productivity because of this distortion. Basically, the economy is not fluid enough, or disruptive enough, to sustain present expectations.

That's simply not a tolerable national outcome. And even less tolerable is the Tory-style "solution": Nonsense about a new era of restraint and expecting less—acquiesced to as ever by a cowardly, insipid left. That "solution", that brilliant fix of great minds and important people, is surely the stuff of Fawlty Towers, not a serious solution to anything!

"Gather around, people! What we need is real economic reform which moves this country forward. It has been brought to my attention that the United Kingdom is now over-developed, with its health care, unofficial ten-hour days and 105-minute commutes to the drab row houses of the outer suburbs. From now on, I am pleased to inform you it will be 12-hour days, untreated limps and poxes, and 125-minute commutes using at least two different forms of public transport.

And, as I'm sure you will agree, it is only with true leadership and reform like this, that we shall see our great nation shine once more like the beads of sweat on our forefather's jewels."

I mean, WTF? And that's exactly what the nation is being told, as if there is no other solution on offer! As if all avenues have been exhausted! As if all the creativity and ingenuity on earth has been exhausted and we are left to conclude there is but one solution: downgrading! As if the good Lord dropped forth a bowl of manna with a single germ in it! That's not a solution, it's an admission of defeat! It's a plan for undevelopment! It's an embarrassment!

Imagine standing there with a straight face and telling society it is overdeveloped. It has overachieved.

I mean, how could even limited strictly rational beings without an ounce of creativity or nous even conclude that folks whose real wages are lagging productivity growth need to cut back so those whose incomes have spiked through the roof can pay less tax! WTF? It's complete lunacy at face value! It's the equivalent of letting Hitler take some of the country because, well, we can't think of an alternative, and anyhow, it's time to cut back as the country is doing too well!

Cutting quality of life and blowing out the wealth gap is not even within the scope of a solution. It's a gross national defeat, and yet such are the lies, propaganda and economic fraud, people have been hoodwinked into standing idly by and letting it happen!

The starting assumption must be that a solution which improves everyone's quality of life is needed, and what is being offered by establishment politics is surrealist comedy of some sort.

_________________

In the end the rain comes down, washes clean the streets of a blue sky town.

Help Nick's: http://www.magpies.net/nick/bb/fundraising.htm |

|

|

|

|

Mugwump

Joined: 28 Jul 2007

Location: Between London and Melbourne

|

| Post subject: |  |

|

I read that twice, and it didn’t really resonate for me.

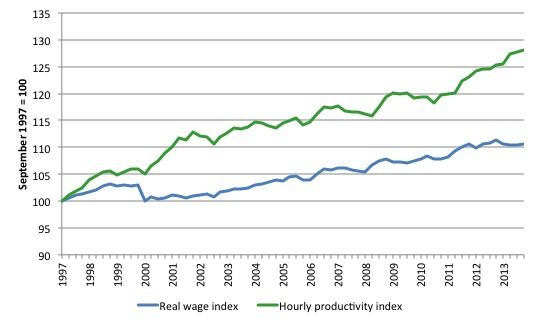

Real wages in the Uk have been keeping pace with productivity. The problem is that productivity has been retarded since the GFC. There are learned journals exploring the possible reasons for this. My favourite reason is that capital investment – public and private - was suppressed by the financial crisis, and the results are showing up some years down the track. Private companies are still hoarding cash rather than spending it, in response to relatively low demand, poor animal spirits, or whatever.

The UK govt's solution has been to increase the minimum wage significantly between 2016-2020, to force idle capital tied up in businesses into the market place – while improving the tax take, and probably – if higher wages make businesses deploy technology to displace expensive labour – drive up productivity as well. It’s a rather bold gamble, a fairly ingenious response, and not all a classic Tory solution. I think it might well be a masterstroke, but time will tell.

I am not sure, either, that the "Tory solution is a new era of restraint and expecting less”. It’s just a determination that the government should actually send roughly in line with its tax receipts, and of course leave to the market what can be best left there. “Austerity” is what Greece is going through. Britain is just paring back after the explosion of spending that Brown and Blair initiated on the back of illusory tax receipts from the financial sector and other excrescences of a credit-fuelled boom. To the Left, “austerity” seems to mean something like a bottle-of-gin-a-day-man cutting down to a few beers after the doctor told him his liver was shot. Is that “downgrading” ? Well, yes, I suppose it is. It’s also life-preserving.

On tax, top-rate taxpayers in the UK are paying ca 20% more tax than they were in 2008 under Blair/Brown, through reduced deductions, the withdrawal of the personal allowance and a top rate that is still 5% higher than it was then. In the UK, almost all of the increased tax burden has been borne by the top of the house (be it right or wrong policy, that's a fact).

Here are the things that I would recommend as a leftist agenda for the times we are living in (it’s a struggle for me, but here goes) :

• A government-owned people’s bank –a vanilla service with no push-selling, clearly defined low-risk profile, and ultra-low-cost vanilla superannuation investment services.

• Simple, no-frills social housing for all citizens, paid for by rents set at a level to yield 2.5% above the government’s cost of borrowing, with long-term (25 years) transfer of equity to long-term tenants with no anti-social behaviour.

• Investment in existing residential property to be forbidden. New build – fine.

• A significant reduction in immigration, which hurts the indigenous working class disproportionately.

• A significant increase in the minimum wage, over time.

• Ensure that multinational corporations operating in-country contribute to the tax base by implementing a revenue-based tax levy, based on their earnings reported to their home stock market

• An end to all tax deductions, matched by a commitment to low maximum tax rate

• Abolition of teacher unions and a rigorous performance appraisal system for teachers with higher rewards for the best. Education is the best route to opportunity and equality. It's been a playground for unionised flat-earthers for too long.

• Free university places for the highest-graded x% (25%?) of students in science and technology, and the top (x-n)% in humanities.

• Working towards an international convention whereby any entry to any OECD country is contingent on the payment of a wealth tax of x% (1.5%?) annually on accumulated wealth above, say, $10m+. You cannot produce the stamp ? Sorry, no entry.

• Mandatory work or study for the dole - again, skills are central to inequality reduction.

• Government subsidy for renewable power development.

All of the above seem broadly practical to me, though it is hardly a costed programme.

_________________

Two more flags before I die! |

|

|

|

|

pietillidie

Joined: 07 Jan 2005

|

| Post subject: |  |

|

| Mugwump wrote: | | Real wages in the Uk have been keeping pace with productivity. The problem is that productivity has been retarded since the GFC. There are learned journals exploring the possible reasons for this. My favourite reason is that capital investment – public and private - was suppressed by the financial crisis, and the results are showing up some years down the track. Private companies are still hoarding cash rather than spending it, in response to relatively low demand, poor animal spirits, or whatever. |

Sticking with the economics for a moment, it is much more likely the GFC was an excuse to officially push the UK further towards the US. Think about it: The policy reaction has been the complete opposite to that which should accompany a simple, wishful GFC anomaly interpretation.

Indeed, the real anomaly here is that the UK had done so well keeping real wages up prior to the GFC; my un-researched hunch would be that hyper-financialisation (and its associated unique historical geography) have enabled the UK to get closer to the sort of economic agility I have in mind for post-industrial economies—sullied of course in the UK's case by an historical class gap and the dumb side of Thatcherite dogma which are expressed in the much longer-standing social polarisation numbers.

As I say, if it's about an anomalous post-GFC productivity dip, then why is the focus not on improving productivity in the UK? Lowering access and cutting productive socioeconomic infrastructure puts more downward pressure on productivity. The fact is, no one deep-down believes it's only about that.

The UK is not Australia under Howard the treasurer requiring modernisation under Keating; quite the contrary given the over-financialisation of the UK.

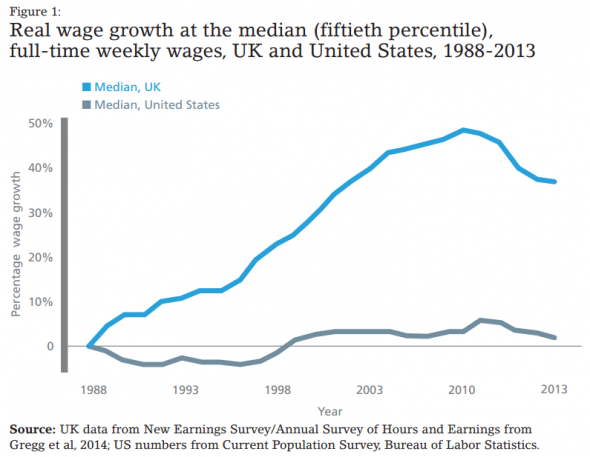

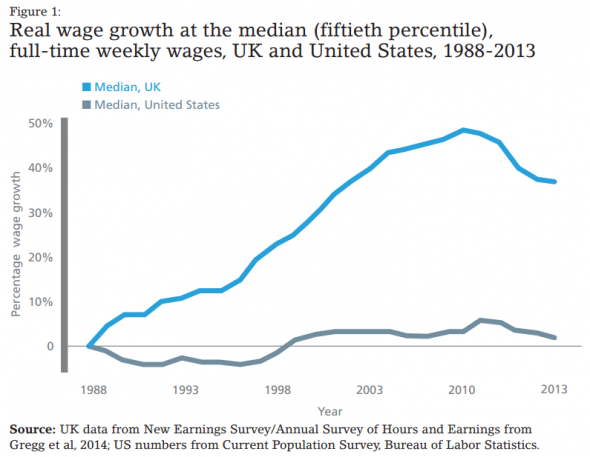

You are referring to this post-GFC UK horror alone:

But leaving the matter there is wishful thinking. One could also solely—and wishfully—blame the commodities boom in Australia for creating a bias towards capital-intensive economic activity. Yes, that's part of the story, but it's also fanciful and beyond that a Tory ruse to leave the explanation at that.

So, despite the Basil Fawlty reference (Tory rhetoric, not mine), I am really interested in the broader postindustrial picture, and expect the same to play out in the UK, give or take some financial island effect.

Much more likely is this: Everyone is catching "up" with the US, including Australia and the G20, and now the UK.

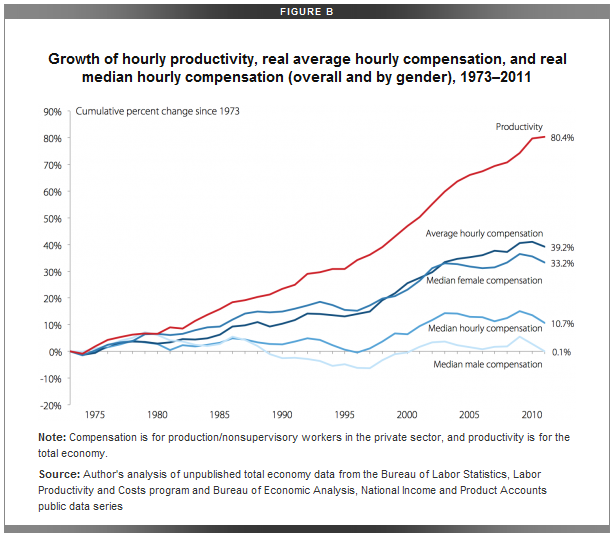

US:

US/UK:

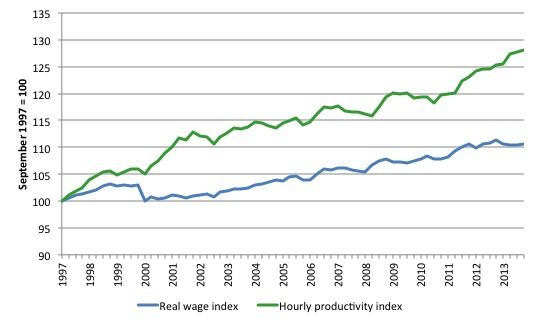

Aus:

G20:

_________________

In the end the rain comes down, washes clean the streets of a blue sky town.

Help Nick's: http://www.magpies.net/nick/bb/fundraising.htm |

|

|

|

|

|

|

|

You cannot post new topics in this forum

You cannot reply to topics in this forum

You cannot edit your posts in this forum

You cannot delete your posts in this forum

You cannot vote in polls in this forum

You cannot attach files in this forum

You cannot download files in this forum

|

|